Economic analysis & Research

Strengthening Democratic Accountability Through Better Fiscal Policy

Key achievements and results

- Established evidence base demonstrating how citizens’ willingness to pay taxes and relationship with government might be improved.

- Developed a cohesive analytical frameworks linking tax policy, governance, social cohesion and democratic accountability.

- Delivered practical policy recommendations for using fiscal decentralization to spearhead strengthen state-society relations.

Problem

Myanmar faces fundamental challenges in state-society relations after decades of authoritarian rule and conflict. The government needed to understand how public financial management and fiscal reforms could strengthen democratic accountability during a critical transition period. Traditional economic indicators failed to capture what mattered to urban residents during rapid political, economic and social change. Without reliable data about citizens’ experiences and expectations, policymakers struggled to make informed decisions about urban development, taxation, and service delivery that could build trust and legitimacy.

Approach

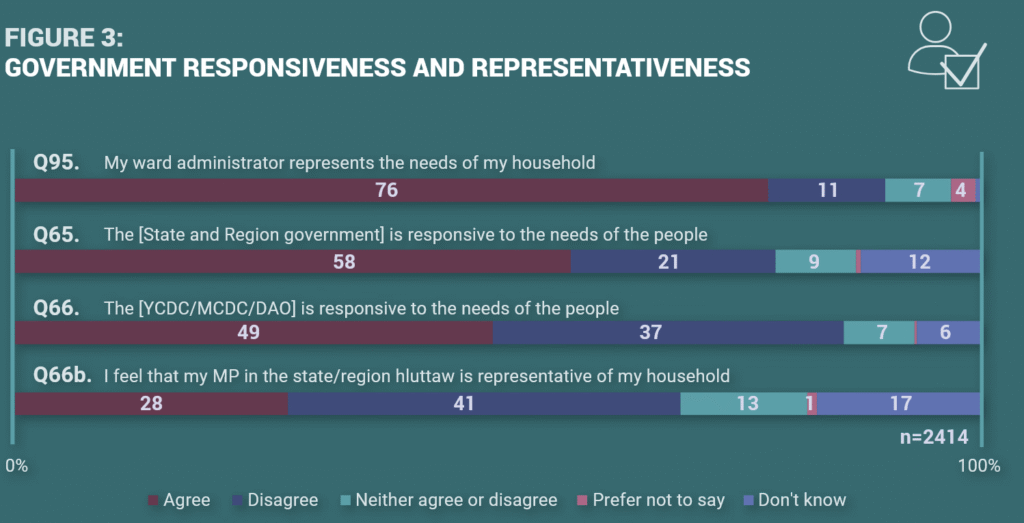

I conducted research that examined how vertical (state-citizen) and horizontal (inter-group) dimensions of Myanmar’s social contract relate to its public financial management systems. The methodology combined statistical analysis of The Asia Foundation’s City Life Survey data with theoretical frameworks from public financial management and democratic governance. The research investigated how tax reform and fiscal decentralization could strengthen citizen-state relationships, with a focus on Yangon, Mandalay, Mawlamyine, Monywa, and Taunggyi. I analyzed residents’ attitudes toward taxation, service delivery expectations, and trust in government institutions to understand the foundations for fiscal policy reform.

Taking a multi-dimensional view of tax policy and governance

Image source: Dickenson-Jones, G., 2020. Public Finances and the Social Contract in Myanmar: Reflections from the City Life Survey, https://asiafoundation.org/wp-content/uploads/2024/08/Public-Finances-and-the-Social-Contract-in-Myanmar-Reflections-from-the-City-Life-Survey_EN.pdf

Results

The research revealed that citizens felt well-represented by local officials, maintained optimism about the future, and expressed willingness to pay additional taxes for improved public services. These findings provided crucial evidence that fiscal reforms could serve as a pathway for strengthening Myanmar’s social contract in the futre. The analysis established clear frameworks for understanding how public financial management influences both vertical accountability (between state and citizens) and horizontal relationships (between different groups). The resulting publication became a foundational resource for policymakers and international development organizations working on fiscal decentralization and democratic governance, directly informing approaches to tax reform and public service delivery.

Trust, accountability and taxation: identifying practical levers for change

Image source: Dickenson-Jones, G., 2020. Public Finances and the Social Contract in Myanmar: Reflections from the City Life Survey, https://asiafoundation.org/wp-content/uploads/2024/08/Public-Finances-and-the-Social-Contract-in-Myanmar-Reflections-from-the-City-Life-Survey_EN.pdf

related case studies

Developed the first comprehensive estimates for the global costs of violence containment across 152 countries and 13 dimensions.

Work with me

Explore how I can help you tackle your most pressing public policy and analytical challenges.